Business Loans

AccessBank provides the following loan products to business owners:

A: Micro Loans from TZS 100,000 to TZS 25,000,000 (higher amounts may be awarded to repeat clients with very good repayment history)

B: SME Loans from TZS 25,000,001 onwards. There is no defined upper limit for loan amounts as the size and term of financing

depends mainly on the strength and debt capacity of your business

Business Loan Competitive advantages

- 1. Flexible collateral arrangements depending on loan size (household goods, business equipment, goods in stock, vehicles, real estate property etc.)

- 2. Lesser documentation requirements than most other banks in the marketplace. No audited financial statements required.

- 3. No prior bank relationship with AccessBank required. You do not need to operate an account with us for any time period before applying. However it is advantageous if you can demonstrate any previous borrowing or banking experience.

- 4. No hidden costs such as additional fees and commissions: You only pay the interest (starting from 2.0% per month on a declining balance). Our loan officers will be glad to assist you with interest rate comparison.

- 5. Long-standing clients with impressive repayment record qualify for successive interest rate discounts and even faster loan processing.

- 6. No borrower groups – you are responsible only for your own loan

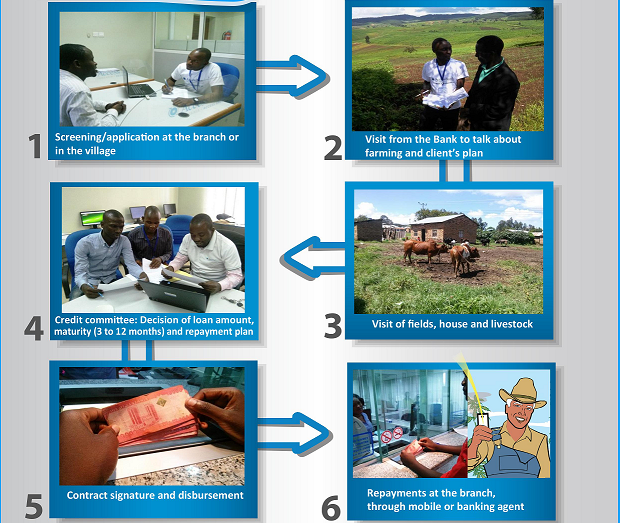

Agro Loan

AccessBank offers Agro loans to individual farmers ranging from 100,000/- to 25, 000,000/- TZS aimed to offer adequate and timely financial support to farmers to enhance their agricultural activities (Inputs supply, Labor, Farm Equipment, Investments etc.

Advantages

- 1. Very fast process: 3 days to get your loan!

- 2. Flexible repayment plan adapted to the individual farming activities and monthly cash-flow

- 3. No necessity to have an account at the bank

- 4. Full transparency and no corruption

Terms and Conditions

- 1. Requirements: Tanzanian of more than 18 years old cultivating and living in the branch operating area for more than 2 years

- 2. Required documents: One among the voting ID, passport, driving license, mwenyekiti/ward letter + business license (if you have a business)

- 3. Collateral: livestock, home and business items, house, fields, motor vehicles

Locations

- 1. Mwanza: Kitengo maalumu cha mikopo KISESA mkabala na kituo cha polisi Kisesa

- 2. Kahama branch: Isaka Road, Majengo

- 3. Tabora branch: Isikie Road jengo la NSSF

- 4. Mbeya branch: Mafiati, Tunatazamana na chuo cha Uhasibu (TIA)